Matt Rourke/AP Photo

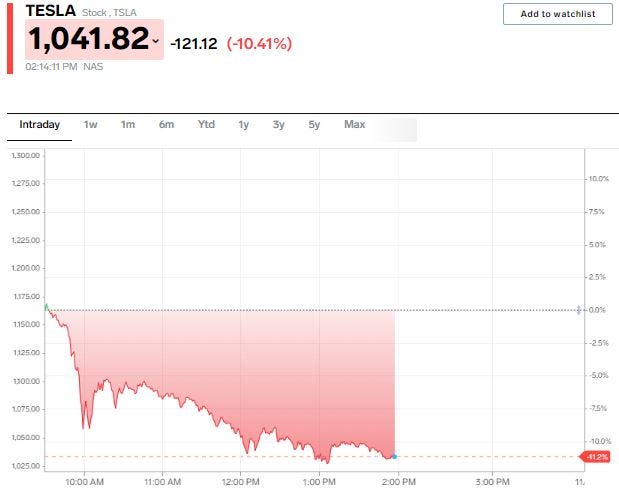

- Tesla stock is on track Tuesday to notch its worst single-day decline since September 2020.

- The EV manufacturer fell as much as 12% amid insider selling anxiety, China car sales data, and a warning from Michael Burry.

- Despite the recent decline, Tesla stock is still up 47% year-to-date amid record revenue and profits.

Tesla stock fell as much as 12% on Tuesday amid a flurry of headlines, including a warning from famed short-seller Michael Burry.

If Tuesday's decline is more than 10.3% when markets close at 4pm, it would represent the company's worst single-day decline since the stock fell 21% on September 8, 2020.

The sell-off in Tesla stock began on Monday after CEO Elon Musk tweeted a poll over the weekend about whether he should sell 10% of his stake in the company, which is worth more than $20 billion. With the results favoring Musk selling part of his stake, he is expected to do just that in the imminent future.

But Musk isn't the only one selling shares of Tesla as it sits at a more than $1 trillion valuation. Musk's cousin and director of the EV company, Kimbal Musk, sold more than $100 million worth of Tesla stock last week.

Adding to Tesla's selling pressure on Tuesday was October China car sales data from the China Passenger Car Association. It showed Tesla sold 54,391 China-made vehicles in October, a 3% decline from September.

On top of that, Tesla's China-made vehicles for export shot up to 40,666 in October from just 3,853 in the prior month, suggesting demand in China fell considerably last month. But that lines up with overall China car sales last month, with passenger car sales falling 14% year over year to 1.74 million vehicles in October.

Finally, a now-deleted tweet from famed short-seller Michael Burry could be adding to the decline in shares of Tesla on Tuesday. Burry pointed out that Musk could be forced to sell part of his Tesla stake due to personal loans he has that are collateralized by Tesla stock.

"Regarding what @elonmusk NEEDS to sell because of the proposed unrealized gains tax, or to #solveworldhunger, or ... well, there is the matter of the tax-free cash he took out in the form of personal loans backed by 88.3 million of his shares at June 30th," Burry tweeted, inferring that Musk may be forced to sell more than 10% of his Tesla stake.

Despite the recent decline, Tesla stock is still up about 47% year-to-date as its business consistently delivers record revenue and profits.